capital gains tax proposal washington state

Washington Capital Gains Proposal Not Helped by Analogy to Real Estate Excise Tax. On November 2nd Washington lawmakers will learn what voters think about it.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Inslees 21-23 capital gains tax proposal QA.

. This proposal impacts approximately 58000 taxpayers and will impact the state general fund in the following ways. Washington state Gov. Inslee proposed in his 2021-23 budget see Gov.

While the appeal is pending the Department will continue to provide guidance to the public regarding the tax as a courtesy. To see what Gov. The statewide capital gains tax placed a 7 excise tax on the sale of stocks bonds and businesses the first tax of its type in state history.

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. Among the most controversial elements of the proposal is a proposal that would make Washington the only state to tax capital gains but not impose a general income tax. The state would apply a 9 percent tax to capital gains earnings above.

Inslee proposes a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. 5096 introduced on Jan. Washington capital gains tax proposal gains traction A new capital gains tax would hit couples earning more than 250000 on their investments.

Washingtons capital gains tax is designed as a direct tax not an indirect one. Although the ballot measure asking voters to recommend on retaining or repealing the new tax is purely advisory this gauge of. Capital assets are personal property you own for investment or personal reasons and do not usually sell in the course of business.

Inslees capital gains tax and a tax on health. This proposal is effective January 1 2022 with the first capital gains tax return due April 15 2023. 5096 which was signed by Governor Inslee on May 4 2021.

Inslees 21-23 capital gains tax proposal QA. This proposal would tax individuals for the sale or exchange of capital assets they have held for more than one year unless an exemption applies. To see what Gov.

The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. If we accept the states argument that its an excise tax then its probably an unconstitutional one because it fails to meet the nexus requirements established in cases like Complete Auto Transit v. The State has appealed the ruling to the Washington Supreme Court.

Following an earlier campaign that ran ads in support of Gov. On March 6 a bill to tax capital gains passed the Washington state senate. However many sales of assets by a business entity are not capital in nature such as sales of inventory.

With hearings scheduled this week for two bills introduced by legislative Democrats that would change Washingtons tax structure advocates are continuing a public campaign to push legislators in the direction of embracing progressive revenue. On May 4th Gov. Proponents of a capital gains tax in Washington have long sought to argue that the tax can be designed as an excise tax rather than an income tax to avoid constitutional constraints imposed on income and property taxation in the state.

It taxes out-of-state earnings and out-of-state activity. The bill is part of a multi-year push by the legislature to rebalance a state tax system that it calls the most regressive in the nation in Section 1 of the bill by increasing. The state would apply a 79 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

Jay Inslee D signed legislation creating a 7 percent capital gains tax to take effect next year. The tax would equal 9 percent of your Washington capital gains. October 25 2021.

The Washington State Supreme Court today expedited the ultimate resolution of the Freedom Foundations lawsuit challenging the capital gains income tax bill passed by the Legislature in 2021 by announcing it will accept direct review of the case effectively allowing the matter to bypass the court of appeals. No capital gains tax currently exists in Washington at the state or local level. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB.

6 by state senators Hunt Robinson and Wilson Nguyen would impose an excise tax equal to seven percent of a Washington residents capital gains starting January 1 2022. The new law will take effect January 1 2022. Only individuals are subject to the tax and the bill exempts an individuals first 250000.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Proposed Washington Capital Gains Tax. The state would apply a 9 percent tax to capital gains earnings above.

A recent KING 5 poll showed support for the tax. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Jay Inslee on Thursday unveiled a budget proposal for 576 billion in general fund spending and a capital gains tax for the 2021-23 biennium.

Just like at the federal level under the proposed Washington capital gains tax when a pass-through entity sells a long-term capital asset the capital gain would be reported and paid by the entity owner s. Tech workers business owners public policy advocates and private citizens weighed in this week in favor of and against a proposed capital gains tax in Washington state. Inslee proposed in his 2021-23 budget see Gov.

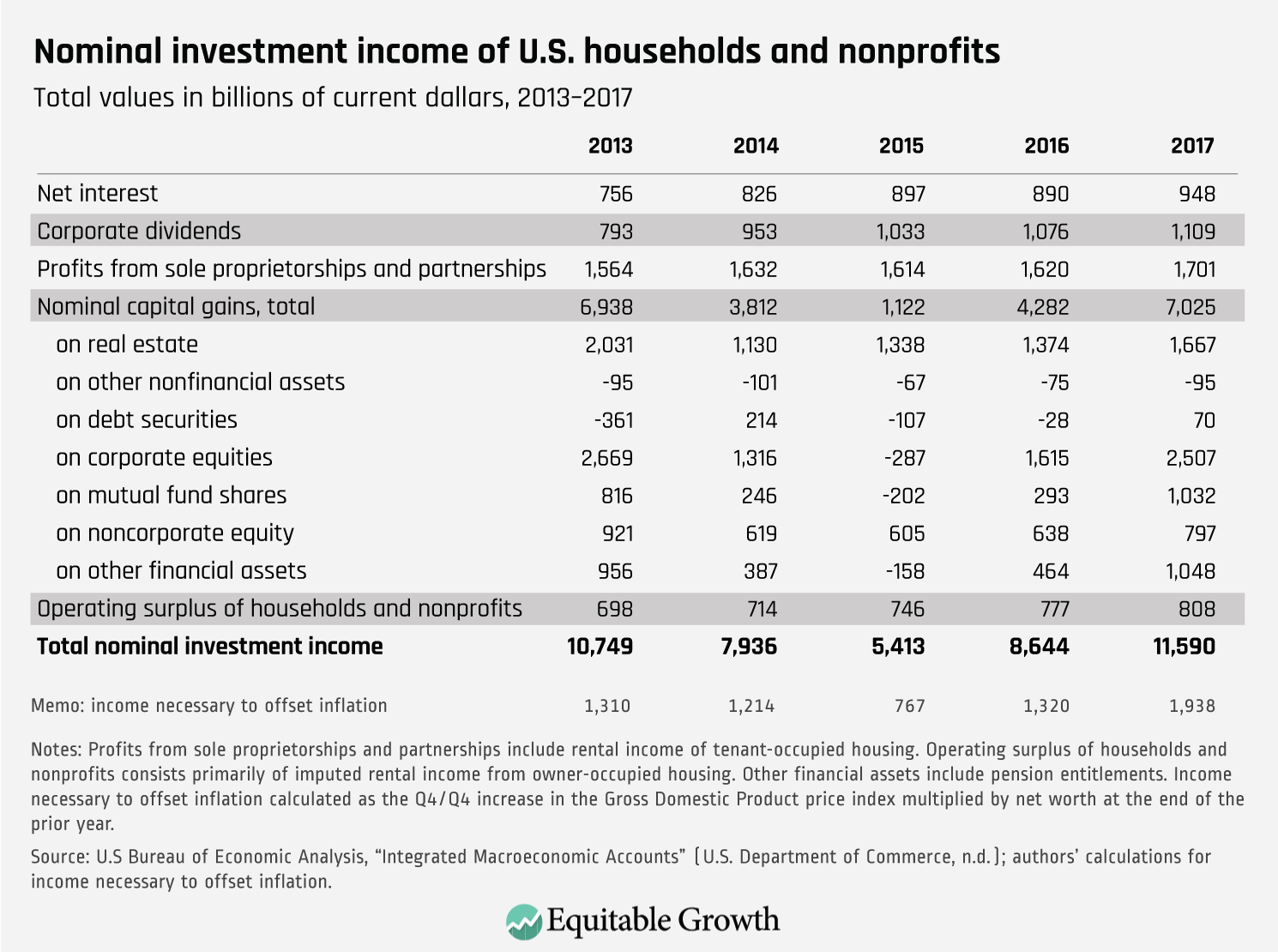

Critics of the plan have already documented how capital gains taxes substantially increase tax volatility but to many it may not be obvious just how volatile capital gains can be.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

State Tax Resource Center 2022 State Tax Resources Tax Foundation

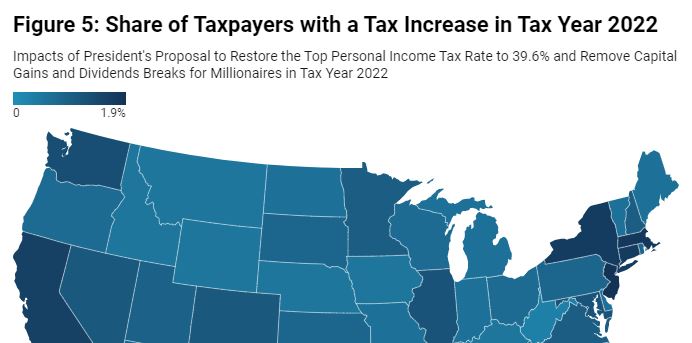

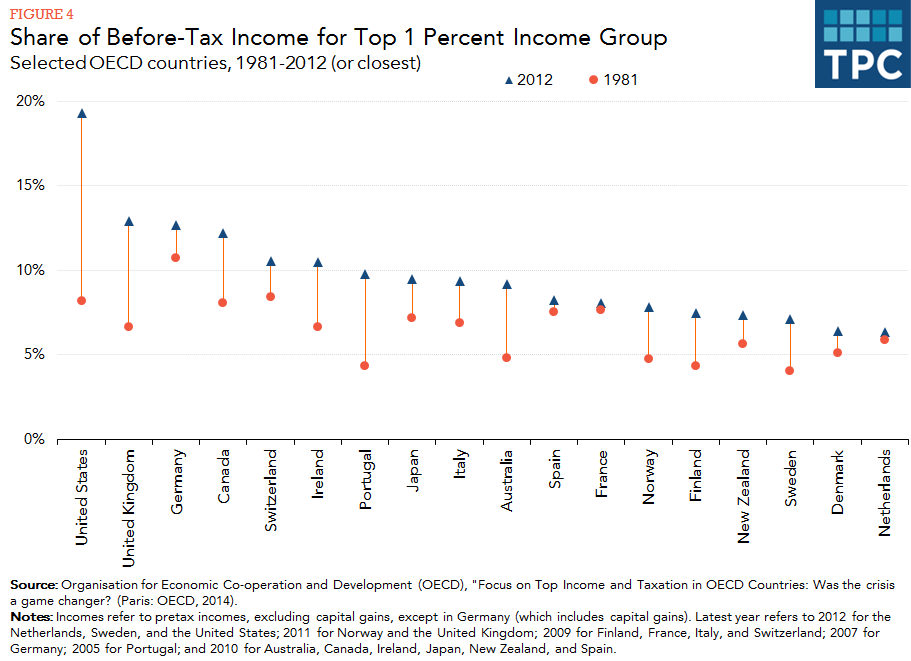

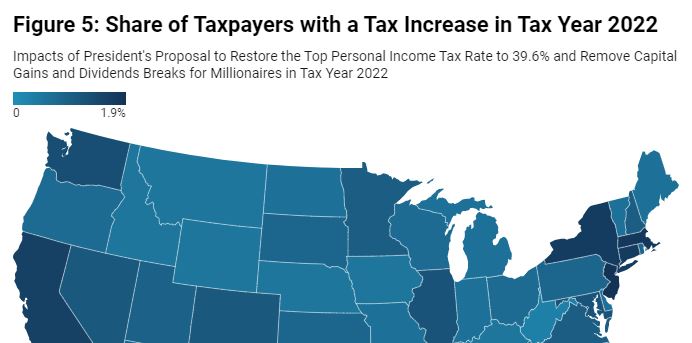

How Do Taxes Affect Income Inequality Tax Policy Center

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

2022 Capital Gains Tax Rates In Europe Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

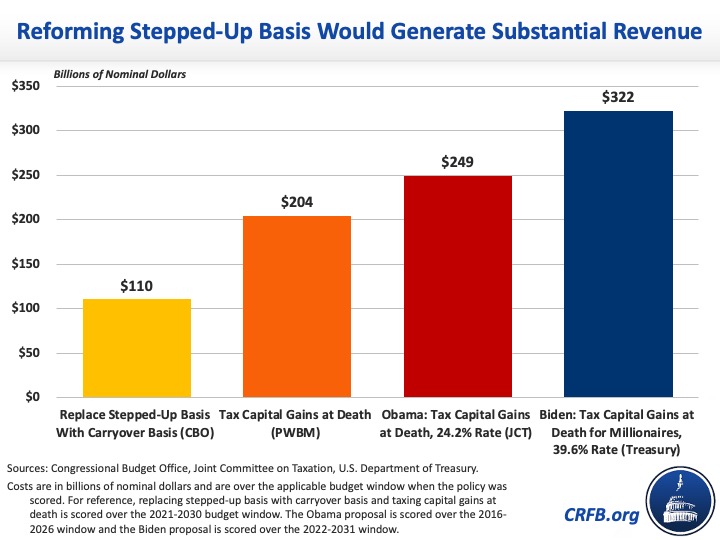

Closing The Stepped Up Basis Loophole Committee For A Responsible Federal Budget

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

![]()

Update Plans To Tax The Rich Advancing In Wa Legislature In 2021 Crosscut

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Income Tax Increases In The President S American Families Plan Itep

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth